Unity Small Finance Bank Boosts CRM Adoption Across 300+ Branches & Onboards Agents 57% Faster with Gyde

Unity Small Finance Bank is one of the newest and fastest-growing small finance institutions, working to bring modern banking services to every corner of the country, including remote and underserved regions. With a robust presence across multiple states, the bank operates approximately 377 branches and offices, serving over 2.3 million customers.

It offers a comprehensive suite of financial services, including savings and current accounts, fixed and recurring deposits, personal loans, and business banking solutions. The bank is also expanding its digital offerings, such as doorstep banking services, to enhance customer convenience.

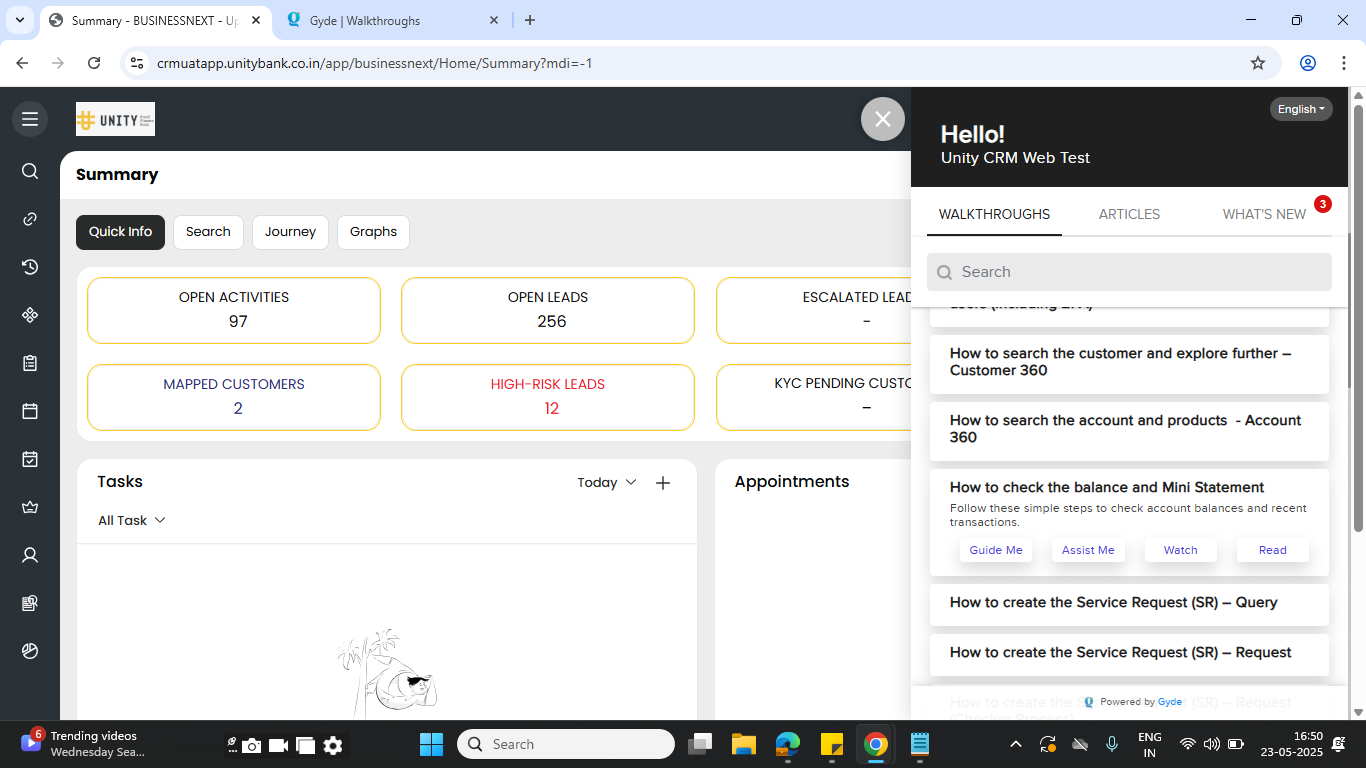

With a strong focus on digital-first experiences, the bank implemented Businessnext CRM to help teams manage leads, onboard customers, and handle account services more efficiently. While CRM centralizes and streamlines operations, putting it into action across Unity's distributed workforce came with challenges:

Frequent employee churn and limited tech exposure made traditional CRM training ineffective. New hires need quicker, hands-on onboarding to start using the system confidently from Day One.

With teams speaking various regional languages, English-only CRM training created confusion and slowed system adoption across branches.

Each branch had its own way of handling tasks, leading to inconsistency in customer service and CRM usage. This made it hard to maintain uniform quality and enforce best practices.

Agents often entered incorrect or incomplete information, such as KYC or nominee details. This impacted compliance, slowed down processing, and reduced trust in the CRM data.

As new features or updates were rolled out, teams struggled to stay informed and adapt quickly. Without timely guidance, changes led to confusion and slowed productivity.

Agents frequently reached out to internal support teams for basic CRM queries, increasing the workload for support staff and slowing down customer-facing operations.

To overcome CRM adoption challenges, Unity Small Finance Bank partnered with Gyde, which helped agents learn, perform, and excel, right within Businessnext CRM.

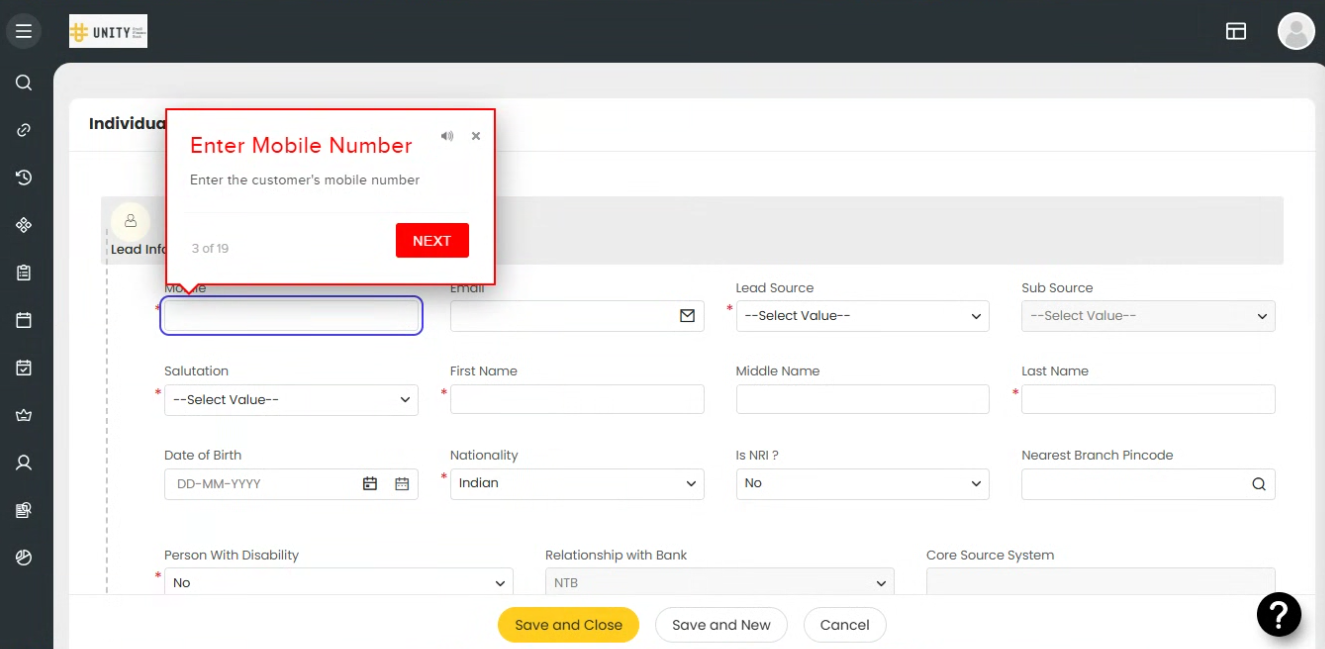

Instructions appeared based on what the agent was doing. This way, they didn't feel overwhelmed and only saw the steps that mattered at that moment.

Key fields, such as ID verification and contact information, were clearly marked. This made it easy for agents to know what to fill in and avoid missing anything.

Agents got on-screen guidance for every task, which helped them learn while working. This removed the need for classroom sessions or reading lengthy manuals.

The guidance was available in multiple local languages. This helped agents across different regions understand the system better and use it confidently.

Agents could hover or click on any field to see what it meant. This made form-filling simpler and reduced the chances of making mistakes.

Gentle reminders popped up to alert agents about important actions, like uploading documents or checking details. This helped them stay on track.

Team leaders could track how agents were using the CRM. They could quickly spot who needed extra help and provide the right support on time.

Unity Small Finance Bank saw a significant boost in CRM adoption across its branches. Training and onboarding times were reduced, allowing new agents to become productive more quickly. Data quality improved, with fewer errors and better compliance. Overall, branch operations became smoother and consistent, leading to a strong return on their CRM investment.

Faster Agent Onboarding

Increase In CRM Adoption

Reduction In Data Errors

Reduction In Support Queries

See How Gyde Can Transform Software Guidance

Become AI Native