Bajaj Finance Limited cuts loan file holds from 18% to 9.7% in just 3 months

Bajaj Finance Limited (BFL) is a prominent financial services company with a vast network and a comprehensive lending portfolio. With over 50,000 employees, the company caters to a diverse 72.98 million customers, providing services across urban and rural areas.

Bajaj Finance Limited invested substantially in Salesforce CRM to improve their lending process. However, they realized that merely having a CRM was not enough, as they continued to face challenges with sales operations and, most importantly, reducing loan files going on hold (which occur when incorrect or incomplete details are present in the loan files).

Bajaj Finance discovered that proficiently utilizing the CRM was essential to mitigate these challenges, which boiled down to providing effective employee training on CRM.

The following were the training challenges they sought to address:

Traditional training methods were time-consuming and not tailored to the needs of employees, leading to inefficiencies in the CRM training process.

Manual data entry by field officers (FOs) led to errors in CRM, causing operational delays such as loan file holds and customer dissatisfaction.

Sales field officers lacked the skills to use the software, as English was not the primary language for everyone, leading to longer training periods.

Bajaj Finance Limited experiences a high churn rate (>45% annually) among off-roll personnel. This constant turnover made CRM training more challenging.

Gyde's digital adoption platform (DAP) has reshaped how Bajaj Finance Limited trains its employees on Salesforce.

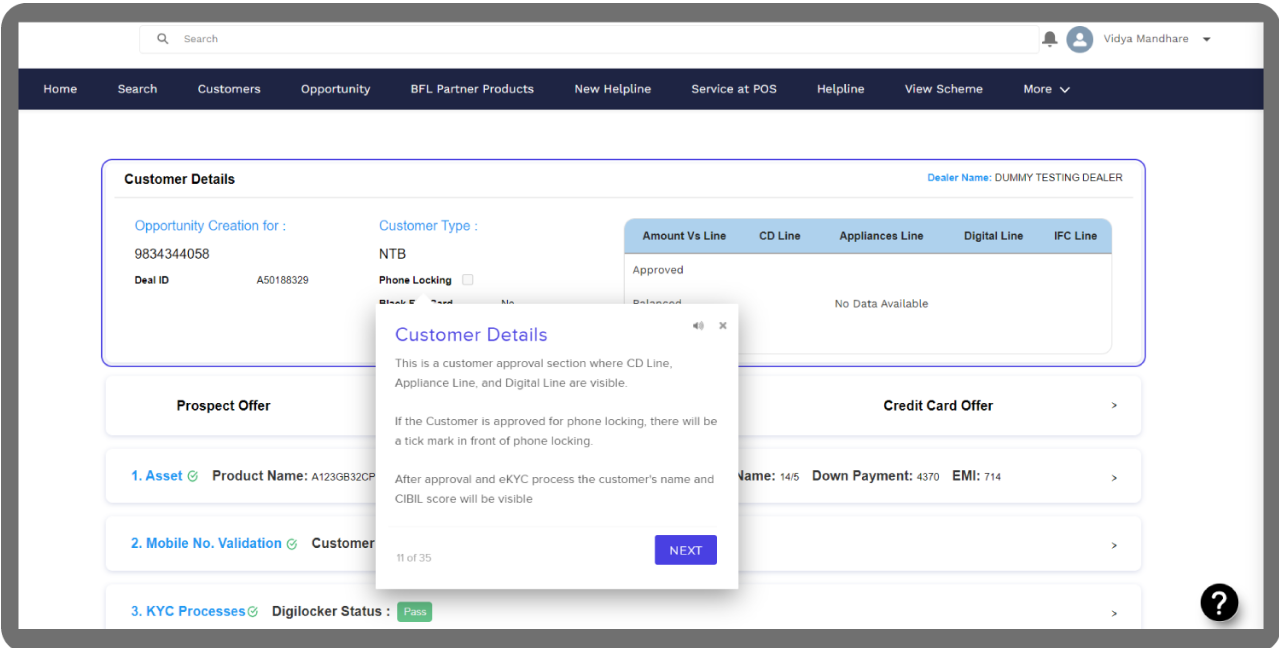

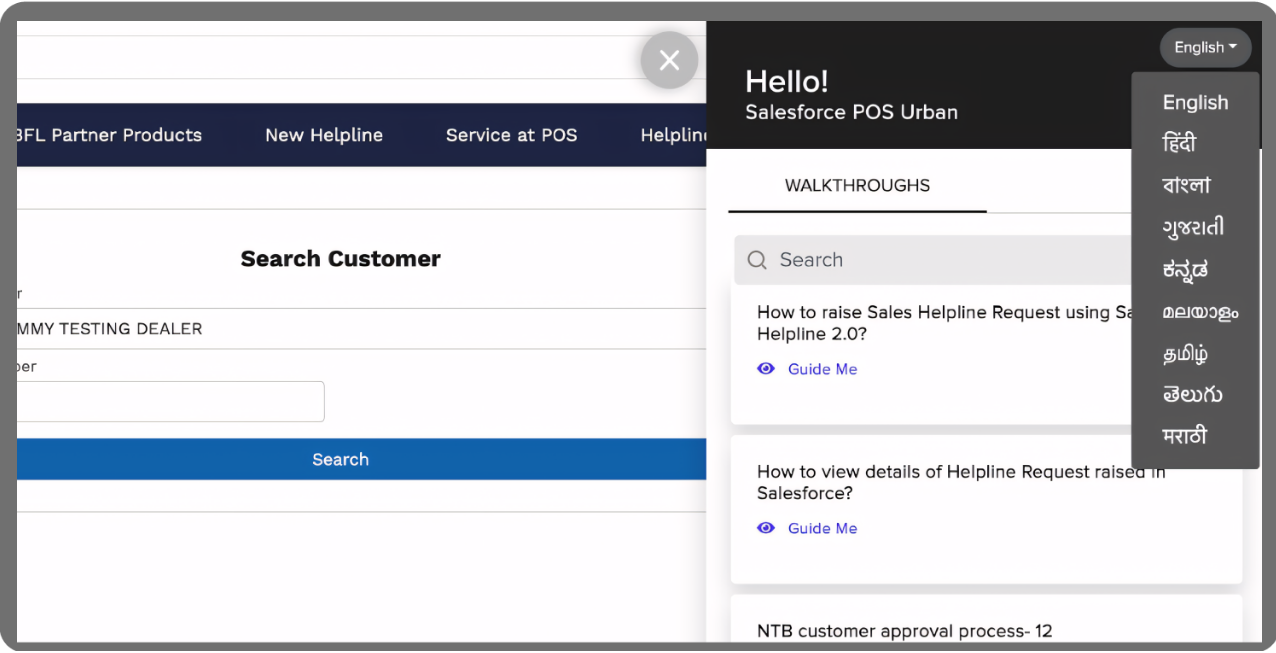

Step-by-step in-app walkthroughs & help articles allowed employees to learn processes on the job. This reduced the learning curve and tackled the training challenge amid a high employee churn rate.

Multilingual feature allowed employees to receive guidance in their native language, resulting in a more personalized, accessible, and impactful training experience.

Auto-assist mode helped employees while filling out loan applications & ensured they input the data accurately, reducing manual data entry errors.

Bajaj Finance Limited tracked CRM employee training to identify areas for improvement and made necessary adjustments, ensuring continuous training enhancement.

The implementation of Gyde's Digital Adoption Platform (DAP) transformed Bajaj Finance Limited's lending operations within three months. The results were indicative of the positive impact on various aspects:

Reduction in loan file hold rates

Reduction in time spent on training

Increment in CRM adoption rates

Increment in employee performance & productivity

See How Gyde Can Transform Software Guidance

Become AI Native